ETHGlobal Unite DeFi — How We Won with ICP

TL;DR

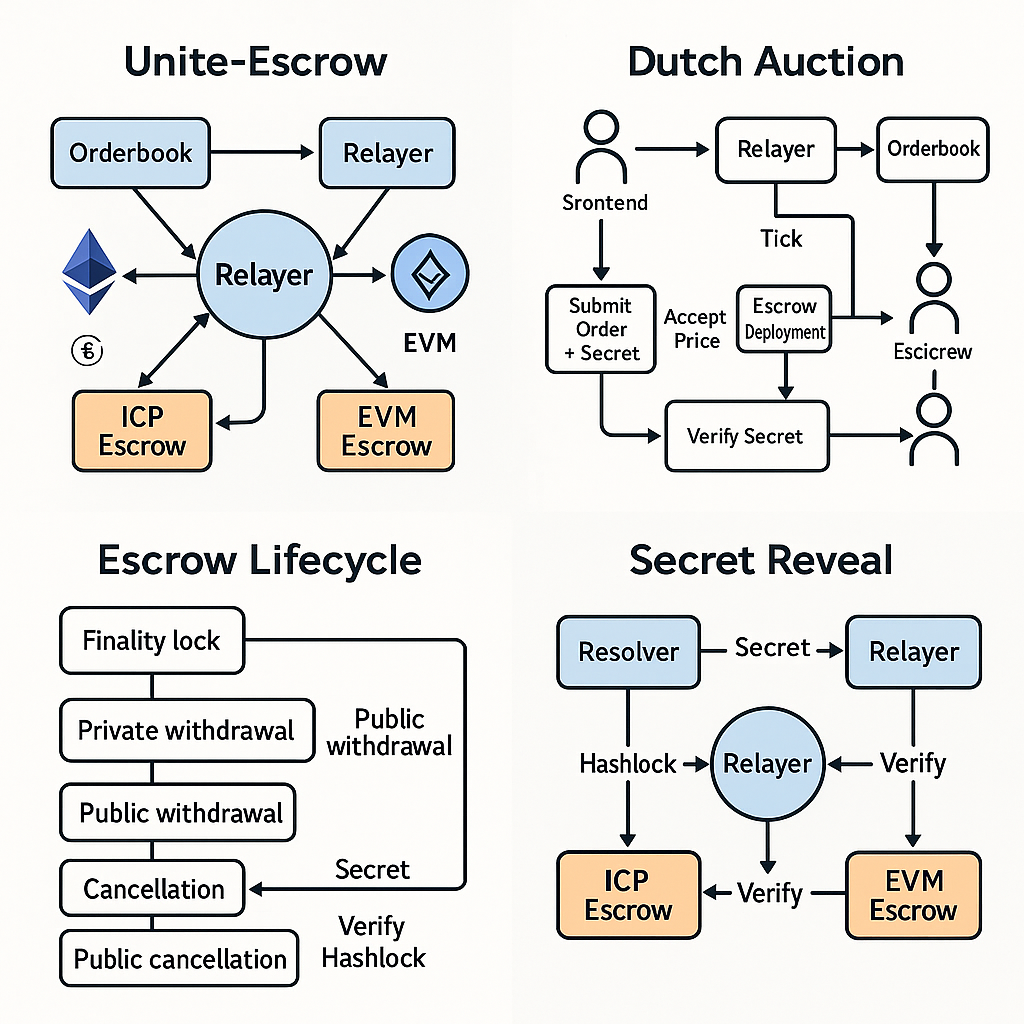

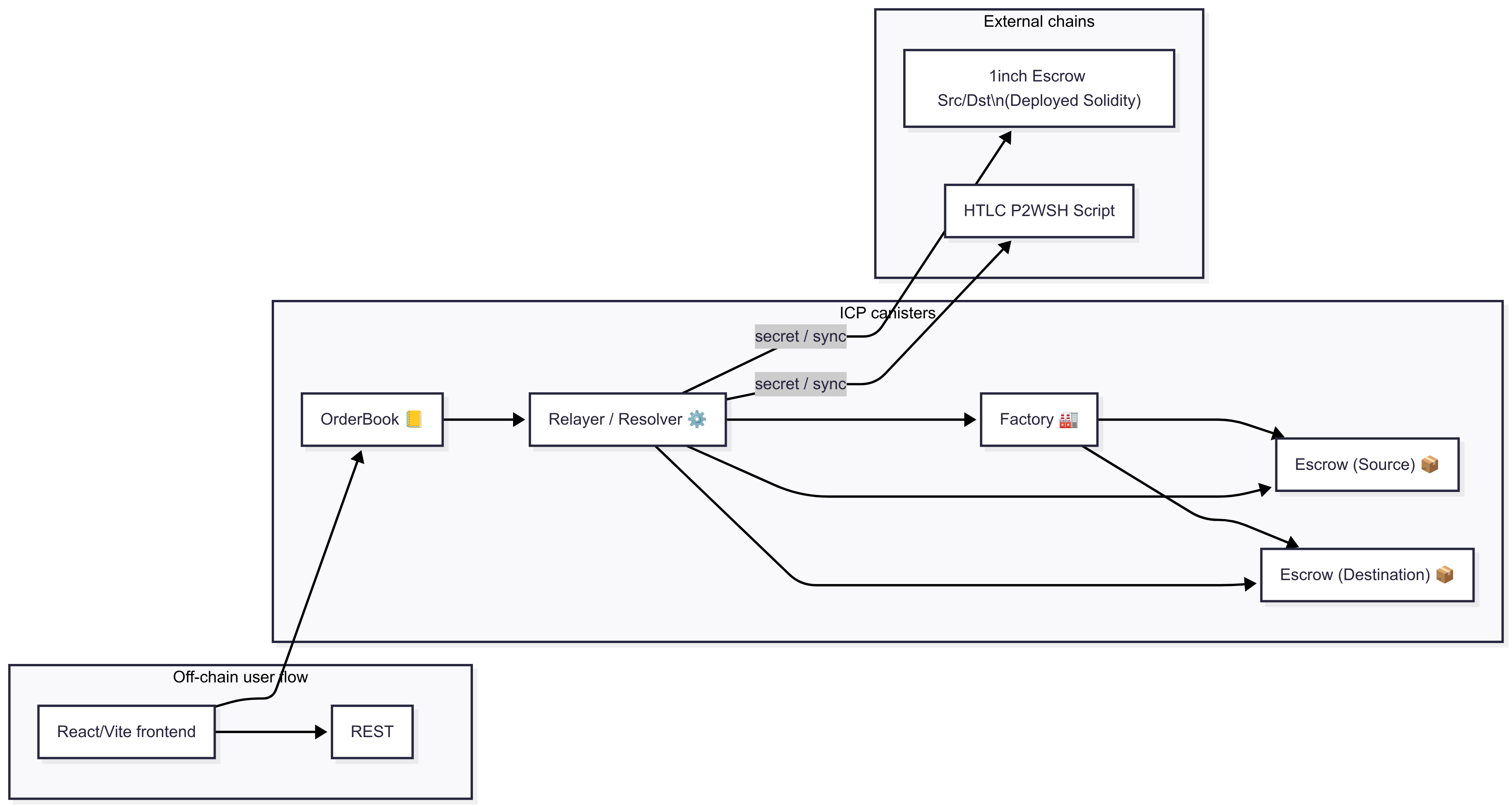

- I rewrote the entire Fusion+ relayer/auction/escrow flow as Internet Computer canisters: Orderbook, Relayer, Resolver, Factory, and a universal Escrow.

- Everything runs on‑chain on ICP; EVM/BTC legs are reached via Chain‑Fusion HTTPS outcalls (no off‑chain servers).

- We won 🥈 2nd prize extending 1inch Fusion+ to ICP. This post documents the architecture, why ICP was the right choice, and the roadmap to production.

Recently I participated in an online ETH Global hackathon mainly featured by 1inch and I focused on something I was thinking about for a while since I first got exposed to 1inch in ETHGlobal Prage some months prior to that. Although I didn't attack that bounty back then, I started wondering how to extend 1inch fusion+'s protocol to ICP. I have already been working in a project for almost a year on the ICP blockchain where I am building a multichain p2p onramping platform so I have gained some experience and gathered some useful insights and knowledge on ICP's setup and framework.

The Unite Defi hackathon featured bounties to extend fusion+ swaps to other chains, so I picked the task of implementing the extension of 1inch swap to ICP. Although I did not focus specifically on the end-to-end swap, I implemented many canisters on ICP to bring many offchain infra needed to secure the swaps in 1inch network onchain using ICP's capabilities. In this writeup I want to summarize my endgoals surrounding all those canisters and explain and showcase each one of them, showcasing ICP's used features and delving into 1inch fusion+ whitepaper along the way of implementing it.

If you follow along you will get some insights into:

- 1inch fusion+ whitepaper theory and implementation details.

- ICP chain fusion and fully-onchain capabilities.

- A modular and scalable canister development framework on ICP.

Feel free to add suggestions and improvements! You can add a PR directly into my repository. And also, don't doubt to contact me if you want to collaborate and bring this project further away.

Why ICP for Fusion+

Fusion+ shines when intents are matched quickly, safely, and credibly. ICP contributes:

- On‑chain automation: deterministic timers (5s ticks), background jobs in canisters, and stable memory for registries.

- Chain‑Fusion HTTPS outcalls: JSON‑RPC to EVM and Bitcoin endpoints directly from canisters—no off‑chain relayer boxes.

- Native ECDSA: canisters sign secp256k1 for EVM flows; clean CREATE2 verification from Rust.

- ICRC‑1/2 ledgers: standard token flows; ICRC‑2 enables auto‑pull escrows (no manual transfer UX).

- Upgrade‑safe state: StableBTreeMap across canisters: Orderbook, Factory registry, Escrow state.

This lets us move 1inch’s off‑chain relayer/resolver logic on‑chain without sacrificing composability or transparency.

Architecture Overview

Roles & Canisters

- Orderbook — Dutch‑auction engine; stores intents and exposes a price curve (piecewise linear multipliers over time).

- Relayer — pulls intents, ticks auctions, elects provisional winners, guards the secret, verifies escrows on both legs, and finally reveals the secret.

- Factory — deploys universal Escrow canisters (ICP/ICRC) and keeps a registry. Funds can be pulled via ICRC‑2 or locked manually (ICRC‑1).

- Escrow — hash‑time‑lock contract with safety deposit:

withdraw(secret)and symmetric cancel windows to match 1inch Solidity. - Resolver(s) — permissionless on‑chain bots that accept prices, deploy escrows on EVM and ICP, and request the secret once both legs verify.

Cross‑chain

- EVM: Relayer/Resolver use HTTPS outcalls to RPC (e.g., Arbitrum Sepolia) to verify constructor immutables and event logs.

- Bitcoin: HTLC P2WSH scripts are generated/checked from Rust (scaffolded during the hackathon). Broadcasting and monitoring also via HTTPS.

Secret & Hashlock Lifecycle

- Maker crafts an order and a 32‑byte secret; the orderbook stores only the hashlock = keccak256(secret).

- Relayer runs Dutch ticks, surfaces best price; Resolver accepts and deploys escrows on both legs (Source/Destination).

- Relayer verifies both escrows (immutables, roles, amounts, timelocks).

- If correct, Relayer reveals the secret to the Resolver.

- Resolver withdraws from both escrows using

withdraw(secret); safety deposit flows as per role.

+-------------+ list_active_auctions() +--------------+

| Resolver | <----------------------------------- | Relayer |

+-------------+ +--------------+

| accept_price(order_hash) if willing

v

+-------------+ deploy escrows +--------------+

| Resolver | -------------------------> | ICP/EVM |

+-------------+ | Escrows |

| +--------------+

| verify_and_reveal_secret()

v

+-------------+ <------------------------- +--------------+

| Resolver | secret | Relayer |

+-------------+ +--------------+

| withdraw(secret) both chainsPer‑Canister Deep Dive

1) Orderbook (Dutch Auction)

- State:

StableBTreeMap<OrderId, Order>with compact structs forAuctionDetail,PriceCurve(points withtime_offset_secsandprice_multiplier). - Tick: piece‑wise linear interpolation to compute current multiplier. Configurable

waiting_period,auction_start_rate,min_return_amount. - APIs:

add_order,get_order,list_orders.

Example order args (abridged)

record {

maker_asset = variant { ICP };

taker_asset = variant { Erc20 = record { chain_id = 421614; address = opt "0x…" } };

making_amount = 100_000_000_000 : nat; # e8s

auction_start_at = 1725000000 : nat64;

waiting_period = 300 : nat64;

price_curve = record {

points = vec {

record { time_offset_secs = 0; price_multiplier = 1.20 };

record { time_offset_secs = 300; price_multiplier = 1.00 };

record { time_offset_secs = 600; price_multiplier = 0.80 };

}

};

timelocks = record { finality_lock = 60; withdrawal = 300; … };

hashlock = vec { …32 bytes… };

}2) Factory

- Responsibilities: store escrow WASM; create new escrows with typed

EscrowParams; keep a registry for lookups. - Cycle‑aware: top‑up friendly; deploy then install WASM with initialization args.

- ICRC‑2 path: auto‑pull on init when allowance is set; ICRC‑1 path: manual

lock()after funding.

3) Universal Escrow

- Assets: ICP / any ICRC‑1/2 token.

- Symmetric logic:

SourceandDestinationroles mirror 1inch Solidity (private/public withdraw + cancellation windows) and pay asafety_depositto the executor. - API:

get_escrow,withdraw(secret),cancel(),rescue_after_public_cancel().

4) Relayer

- Auction brain: imports intents from Orderbook; runs 5s

tick()timer; computes current price and provisional winner. - Secret guardian: stores the maker secret; only reveals after both escrows verify.

- Cross‑chain verification: encodes/validates EVM constructor immutables (

encode_src|dst_immutables) and CREATE2 address math; checks ICP escrow params from Factory registry. - API:

submit_order(order, secret),accept_price(order_hash, resolver_addr),verify_and_reveal_secret(evm_escrow, icp_escrow, order_hash, resolver_evm).

5) Resolver (Manual or Automatic)

- Manual demo mode: deploy EVM escrow via HTTPS‑RPC; deploy ICP escrow via Factory; then call

verify_and_reveal_secret(). - Automatic mode: configurable policy:

automatic_tick = {

max_slippage_bps = 100; # 1%

poll_interval_sec = 30; # cadence

min_profit_icp = 1_000_000; # 0.01 ICP floor

filters = { allow_assets = []; deny_assets = [] };

}This enables a permissionless network of resolvers competing on auctions with risk‑controlled strategies.

End‑to‑End Demo (Local, Reproducible)

Full scripts live in the repo under

docs/. Below is the condensed path judges saw live.

- Spin up

dfx start --clean- Deploy Orderbook and Relayer

# orderbook

cargo build -p orderbook --target wasm32-unknown-unknown --release

candid-extractor target/wasm32-unknown-unknown/release/orderbook.wasm > backend/orderbook/orderbook.did

dfx deploy orderbook

# relayer (init with RPC + orderbook id)

dfx deploy relayer --argument-file tmp/relayer_init.did- Factory + Escrow WASM + Local ICP ledger

cargo build -p factory -p escrow --target wasm32-unknown-unknown --release

candid-extractor target/…/factory.wasm > backend/factory/factory.did

candid-extractor target/…/escrow.wasm > backend/escrow/escrow.did

dfx deploy factory --with-cycles 1_000_000_000_000

python3 scripts/gen_escrow_arg_did.py

dfx canister call factory set_escrow_wasm --argument-file tmp/escrow_arg_hex.did- Mint test ICP; approve Factory (ICRC‑2)

dfx deploy icp_ledger_canister --argument "(variant { Init = record { … }})"

dfx canister call icp_ledger_canister icrc2_approve '(record { … amount = 100_000_000_000 })'- Submit order intent (with secret); Relayer starts Dutch auction immediately

dfx canister call relayer submit_order --argument-file tmp/submit_order_icp.did- Resolver accepts price and deploys escrows (EVM+ICP)

dfx canister call relayer accept_price '("0x…order_hash…", "0x…resolver_evm…")'

# ICP leg via Factory; EVM leg via Resolver RPC call- Relayer verifies immutables → returns secret

dfx canister call relayer verify_and_reveal_secret '(

"0x…evm_escrow…",

"…icp_escrow_principal…",

"0x…order_hash…",

"0x…resolver_evm…"

)'- Withdraw both legs with the secret

# ICP

dfx canister call <ESCROW_ID> withdraw '(blob "0x…32‑bytes…")'

# EVM (manual helper on Resolver for demo)

dfx canister call resolver withdraw_evm_manual '("0x…order_hash…", blob "0x…")'The funds and safety deposits move exactly according to 1inch escrow semantics.

What Went Well vs. What I’d Change

Went well

- Full ICP leg is 100% on‑chain and modular; per‑role canisters with minimal trust surfaces.

- Secret flow is provably correct and symmetric; escrow registry makes audits straightforward.

- Resolver policy knobs (

min_profit_icp,max_slippage_bps, asset filters) make decentralization practical.

Change next

- Ship a thin UI for resolvers/makers; today’s CLI is fine for power users only.

- Roll EVM escrow on Arbitrum Sepolia + CREATE2 verifiers in relayer.

- Add partial fills and multi‑winner splits in the Orderbook (stretch goal).

Why This Matters to 1inch (Grant Angle)

Today: Fusion+ relies on a curated, KYC’d relayer set.

Proposal: Keep Fusion+ semantics but offer an optional fully on‑chain resolver/relayer layer on ICP:

- Credible neutrality — auctions, secrets, and reveals happen in publicly verifiable canisters.

- Permissionless resolver market — anyone can run a resolver with risk controls; fees and safety deposits align incentives.

- Operational simplicity — no off‑chain service to host; Chain‑Fusion brings RPC right into canisters.

- Composable — other IC DeFi protocols can integrate intents natively (vaults, perps, treasuries).

- Resilience — canisters upgrade safely; state is durable; timers are deterministic.

Net effect: broaden Fusion+’s reach without weakening guarantees, while opening new liquidity venues on ICP.

Roadmap (Grant Milestones)

M1 — EVM Escrows on Arbitrum Sepolia (4–6 weeks)

- Deploy Source/Destination escrows; finalize CREATE2 + event verification in Relayer.

- Happy‑path bidirectional swaps (ICP ↔ ETH/USDC). CI + reproducible local+testnet scripts.

M2 — Production Resolver Network (4–6 weeks)

- Automatic Resolver with policy DSL, gossip for auction discovery, and slippage/profit guards.

- Monitoring + metrics (success rate, reveal time, MEV windows). Partial fills prototype.

M3 — UI + Docs + Security Hardening (4–6 weeks)

- Minimal Maker/Resolver web UI (Vite + React), wallet flows for ICRC‑2 approvals.

- Formalized audits for Escrow/Factory; invariant tests; fuzzing secret/timeout edges.

- Mainnet rollout plan with phased limits.

Dev Notes & Edge Cases

- Timelocks:

finality_lock → withdrawal → public_withdrawal → cancellation → public_cancellationmirrors 1inch; both legs must be configured consistently. - ICRC‑1 vs ICRC‑2: auto‑pull only when spender allowance is set; else fall back to explicit

lock(). - Verification:

verify_and_reveal_secretrejects mismatched immutables, wrong roles/amounts, or out‑of‑window escrows. - Latency: 5s relayer ticks felt good locally; remote RPC variance suggests adaptive backoff in production.

Links & Demo

- Repo: https://github.com/reymom/Unite-DeFi-ICP

- Demo video: https://youtu.be/oiNU9ANHoNw

Timestamps

- 00:00 — Architecture (Orderbook ▸ Relayer ▸ Factory ▸ Escrow ▸ Resolver)

- 04:24 — Local dfx swap test: deploy orderbook

- 06:20 — Factory deployment and escrow WASM upload

- 07:14 — Relayer config and deployment

- 08:05 — Resolver (manual)

- 08:45 — Submit order intent

- 10:45 — Dutch auction:

accept_price - 11:30 — Deploy escrows; relayer verification

- 14:00 — Withdraw ICP + mocked EVM leg

- 14:30 — Why this matters

Appendix — Local Repro Cheat‑Sheet

Full versions in

docs/:

- Orderbook: build, deploy,

add_order,list_orders. - Relayer: init with RPC + orderbook id;

submit_order;list_active_auctions;accept_price. - Factory/Escrow: set escrow WASM;

create_escrow;get_escrow;withdraw(secret). - Resolver: manual

deploy_evm_escrow; automatic mode withautomatic_tickpolicy.

# Start network

$ dfx start --clean

# Quick calls you’ll actually use while testing

$ dfx canister call relayer submit_order --argument-file tmp/submit_order_icp.did

$ dfx canister call relayer accept_price '("0x…", "0x…")'

$ dfx canister call factory create_escrow --argument-file tmp/create_icp_source_escrow.did

$ dfx canister call relayer verify_and_reveal_secret '("0x…evm","…icp","0x…order","0x…resolver")'

$ dfx canister call <ESCROW_ID> withdraw '(blob "0x…32bytes…")'If you’re from 1inch and want a live walkthrough or code deep‑dive, ping me—happy to demo resolvers racing on a local network and discuss a phased mainnet rollout.

Stay Updated

Get notified when I publish new articles about Web3 development, hackathon experiences, and cryptography insights.

You might also like

icRamp Devlog #21 — Vault Refactor & ic-alloy EVM Reads

Final milestone wrap-up: IcRamp v2 with a simplified vault, ICP-driven state instead of on-chain commit/uncommit, and ic-alloy-powered EVM reads for getDeposit.

icRamp Devlog #20 — Pay with Crypto (Settlement & Verification)

We finish the pay-with-crypto flow: from Locked orders to on-chain payments, matching provider assets, and verifying EVM/Solana txs on the backend.

icRamp Devlog #19 — Pay with Crypto (Frontend UX & Provider Flows)

Frontend wiring for the experimental 'pay with crypto' path: crypto providers in the user profile, filtered provider selection in Create Order, and a compact order card UX for onrampers choosing how to pay.